I’ve been a fan of Ally Bank since the early days and it’s been my main bank for many years.

I’m a big fan of Ally Bank as a bank given all of its perks and it’s made even better when there is a bonus. If you want to learn more, our deeper review of Ally Bank will help you understand why I like them so much.

Ally typically offers two types of bonuses:

- Ally Bank – for checking, savings, and other deposit products

- Ally Invest – for self-directly and managed brokerage accounts

Table of Contents

Ally Bank $100 Referral Bonus

Ally Bank is offering a referral bonus when you open up an eligible Ally account – includes savings account, spending account, or a self-directed trading account (investing). The terms will depend on the account you open but you must enroll in the program by 12/31/2024.

Then meet the conditions below:

For the savings account, you must set up (within the new account) and start a monthly automated recurring transfer within 30 days of opening. Complete at least 3 back-to-back monthly automated recurring transfers and you will get your $100 bonus within 30 days of the third transfer.

For the spending account, you must set up and receive a qualifying direct deposit within 60 days. Bonus is transferred within 30 days of receiving that transfer.

For the self-directed trading account, transfer a minimum of $1,000 within 60 days of opening your account (can be multiple transfers). Again, bonus is transferred within 30 days of your account reaching $1,000.

To start, you must get a referral (the link below comes from Jonathan at My Money Blog, I don’t have one despite having an account there for ages) and enroll in the program.

👉 Learn more about this promotion

Ally Bank Spending Account Bonus – $100 [EXPIRED]

This offer is no longer available.

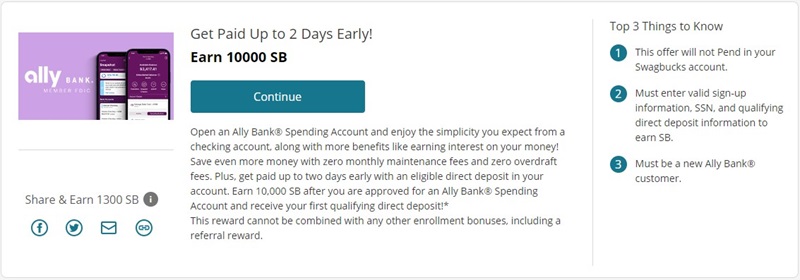

Ally Bank is running a promotion for the Spending account (their checking account) through the rewards site Swagbucks. You have to sign up for Swagbucks, which is free, then search for the Ally Bank offer:

You will be awarded 10,000 Swagbucks when you open an account and receive your first qualifying direct deposit. You can’t pair this with another Ally Bank offer or you lose the Swagbucks. 10,000 Swagbucks can be redeemed for $100 through PayPal (or you can get gift cards).

To find the offer, just search “Ally Bank” in the search bar at the top:

Ally Bank Savings Account Referral Bonus – 0.50% of New Deposits up to $125 up to $125 [EXPIRED]

Ally Bank has a referral bonus offer where you can get a 0.50% cash bonus on new money deposited into your account.

You have to open a new Ally bank Savings Account by 3/1/2024 and deposit new money by 3/29/2024. Then, keep the cash in your account until 7/15/2024 and you get an extra 0.50% of interest on top of their current interest rate (which is 4.00% APY) – up to $125. If you deposit $25,000, then you’ll get the maximum $125.

The referral program is still a pilot program (and I wasn’t included, despite having an account there since 2009!) so I don’t have a link.

🔴 The button below goes to the promotional page, make sure you get a referral link!

(here are the official terms & conditions of the offer)

(Offer expires 3/1/2024)

Ally Bank Spending Account – $200 Bonus [EXPIRED]

Editor’s Note: As of October 12th, 2023, Ally Bank is no longer offering this new account bonus – they closed it ahead of the published deadline of October 13th. For other bank bonuses, check out our post on the best bank bonuses and promotions or click here to sign up for our email newsletter and get notified of new bank promotions. While there are no bank bonuses, there are a few credit card bonuses worth checking out!

Ally Bank doesn’t offer a bonus on their checking accounts very often so it’s a nice treat to be able to share this one with you today.

You can get $200 from Ally when you open an Ally Bank Spending Account using the promo code GET200 before 10/11/2023.

Then, set up one or more direct deposits that total at least $1,500 within 90 days. Once you satisfy those conditions, you’ll get your bonus within 30 days.

You are eligible if you are a new customer and have not received a cash bonus from Ally Bank within the last 12 months for setting up a qualifying direct deposit.

A nice little bonus for a reasonable direct deposit requirement.

(Offer expired 10/11/2023)

Ally Invest – $100 [EXPIRED]

Ally Invest has a $100 promotion on their Self-Directed Trading and Robo Portfolio account.

You have to:

- Open an Ally Invest Self-Directed Trading account or Robo Portfolio using the links on this page by 02/22/2023.

- Set up and start a monthly recurring transfer in an amount of your choice within 30 days of opening your account.

- Complete at least 3 consecutive monthly recurring transfers by 05/23/2023.

- Keep your Ally Invest account open and in good standing until we deposit your $100 cash bonus.

In the terms and conditions, it does say “

This unique offer is only available to select Ally Bank customers. Only the original email recipient is eligible and this offer cannot be transferred or shared. We’re all about playing fair, so if we believe you’re trying to game or abuse this offer, you won’t be allowed to participate in this offer or any future offers.”

How Does This Bonus Compare?

Since Ally Bank doesn’t have an active bank promotion, it’s hard to compare but here are a few great live offers.

U.S. Bank – up to $450

Earn up to $450 when you open a new U.S. Bank Smartly® Checking account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through December 31, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

BMO Checking – $300

BMO is offering a $300 bonus* when you open a BMO Checking account and have $4,000 in direct deposits within 90 days of opening. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $300 Bonus Offer

Bank of America offers a $300 Bonus Offer cash bonus if you open a new account and Set up and receive Qualifying Direct Deposits* totaling $2,000 or more into that new eligible account within 90 days of account opening. Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

If none of these catch your eye, we maintain a list of the best bank promotions here.